If you are looking for debt settlement with American Express you should know they handle themselves a bit different than the other major credit card companies. Visa, Mastercard and Discover typically sell their delinquent accounts to collection agencies for a reduced rate and then write them off the books. American Express, however, does not do this. They handle all of the debt collection in house and will rarely sell any of its accounts.

If you are looking for debt settlement with American Express you should know they handle themselves a bit different than the other major credit card companies. Visa, Mastercard and Discover typically sell their delinquent accounts to collection agencies for a reduced rate and then write them off the books. American Express, however, does not do this. They handle all of the debt collection in house and will rarely sell any of its accounts.

The reason we point this out is to avoid asking them to validate the debt. When trying to settle a debt the first thing you would do with a collection agency is to ask for a validation letter. Since it is in house, American Express can easily generate these documents. Once they are generated and the debt is valid they can immediately move the case to a legal firm. This will put you behind the eight ball at the start. Below we have the best practices for debt settlement with American Express.

How to settle an American Express credit card account

First of all, don’t try to settle the debt if it is not past due. You will be wasting your time. You need to be 90 to 120 days behind in your payments before contacting them with a debt settlement. If your account is 30 to 60 days past due American Express will more than likely not settle. Instead they will work with you and schedule payments until your debt is paid in full.

A phone call to the company is the best start to settling your debt with American Express. Call them explain your situation and ask to get the balanced reduced in exchange for a lump sum payment. American Express has settled thousands of accounts in the past so the representative on the other end of the line will be familiar with the process. You can expect a savings of 40 to 90 percent of the total balance owed. Your negotiation skills and how well you can convince the representative of your bad financial status will determine the amount you have to pay.

Once you come to an agreement on an amount you need to pay, make sure to get the agreed amount in writing. Do not make any payments to them until you receive your settlement letter. Once you have this in hand you have legal rights to the agreed upon amount and you can safely make your payment.

What to do if you are sued by American Express for credit card debt

If you are being sued by American Express then you are at least 120 days past due on your account. A representative from a law firm will be contacting you instead of an American Express collections rep. If it gets to this point we recommend hiring a professional debt settlement company such as Curadebt to represent you. Curadebt has been working with American Express and settling accounts for 20 years.

Curadebt will more than likely be able to get a more discounted settlement than you would be able to negotiate on your own. Along with this, if you do not have the funds to pay a lump sum payment, Curadebt can consolidate all of your debts into one payment and make settlements with all of your creditors. This will help free up cash flow for you and give you a bit more peace of mind.

We have thoroughly investigated Curadebt and are familiar with their practices. They have proven themselves time and time again. At Sunbeam Financial we give Curadebt a 5 star recommendation. For more information click on the highlighted text or the banner in the sidebar that says “Our #1 Recommendation”.

What does an American Express debt settlement letter look like?

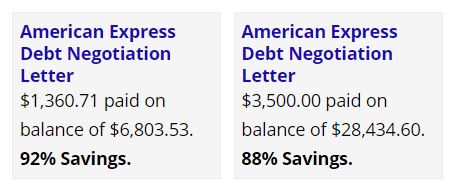

Curadebt can help you with your debt settlement with American Express. The easiest way to convince you of this is to show you the proof. There are many more but we have included pictures of a few accounts that Curadebt successfully settled with American Express. The settlement percentage ranges from 45% to an amazing 92% savings.

The settlement we have is from October of 2018. The debt was reduced from $5,311 to $1,860.

American Express debt settlement letters:

We have included a few more accounts that Curadebt was able to settle with American Express. Unfortuantely, we don’t have the actual documents but here are the balances and the agreed upon amount. If you would like to see more accounts from American Express and other companies you can see them here.

It is time to get the creditors off you back and get your financial life back in order. Curadebt can help you achieve financial success. Give them a call and receive a free consultation. They will let you know the best service and how to get back on track.