Sometimes people get so behind in their credit card and personal debts that it would take many years to get back on track. Paying the minimum payments each month is just treading water and getting you nowhere. When this happens people turn to debt settlement. Here we have debt settlement letter samples and proof that it works!

Why would a credit card company accept a settlement?

At Sunbeam Financial we get this question all the time. The answer is simple. It is better to receive some money than nothing at all. If a person’s financial status is in dire straights then the credit card company is willing to take a small loss on the account rather than have to write it off entirely. Every year creditors settle thousands of accounts that are past due for pennies on the dollar. What percent of the debt can you settle for? That depends. Each situation is different. Settlements are negotiated on the amount of available funds you have, the type of debt it is, and your ability to effectively negotiate.

The credit card company will usually be willing to take a lower percentage for a lump sum payment. However, this is not always possible depending on the amount of savings you have available. If this is the case, you can still negotiate with them and make monthly payments for a reduced amount.

Is debt settlement worth it?

This is something that you will have to decide on your own. Weigh the positives and negatives and come up with the best solution. Don’t let any company pressure you into using their services. Let it be known that debt settlement will hurt your credit for awhile since you are not paying your debts in full. This is the major drawback. However, if your credit is poor to start with or you are not concerned with your credit then settlement is a good solution.

As a general rule at Sunbeam Financial, we believe if it will take you 5 years or more to pay off your current debt then a settlement is a good idea. Yes, negotiating a settlement will hurt your credit but once your debts are clear you can quickly work on repairing your credit. With on time payments and a little preparation you can repair your credit back to where it was or better in less than the 5 years+ it would have taken to pay your debt in full.

Should I use a debt settlement company or try to negotiate on my own?

Of course you can try to negotiate a settlement on your own but we suggest working with a professional company with a proven record. We have partnered with Curadebt to help our clients get the best results from debt settlement. Curadebt has been in business for more than two decades. They have the experience behind them that you will be looking for. Along with this their fees are very competitive and even slightly below the industry norm.

They offer a free financial analysis and will suggest the appropriate program for your situation. Click the link below for more information and learn more about the programs they offer.

Our Recommended Debt Settlement Company

Real Debt Settlement Letter Examples

Before you start working with a debt settlement company you need to have them send you examples of proof from their previous cases. If they are not willing to do this then you should move on. Curadebt is straightforward with all of their clients and can show you proof of their services. Below we have pictures of real debt settlement letter samples from real clients.

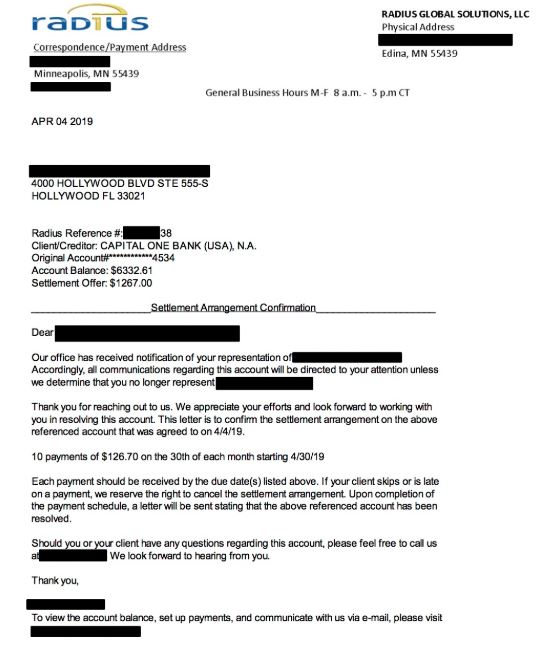

The first debt settlement letter example we have is with Capital One credit cards. The client owed a total balance of $6332.61 and with the help of Curadebt they were able to settle this account for $1,267! That is 80% off of the original balance! Imagine how much faster you can get out of debt when you can reduce your balances by this much.

Sample letter #1

Please keep in mind each situation is unique and Curadebt is not able to guarantee 80 percent savings on every account. This is just an example of one of their cases. Depending on the creditor you will more than likely save between 40 to 80 percent of your debt. The good news is Curadebt has been working with these companies for many years and have developed a strong relationship with them. Curadebt is familiar with the amount each company will be willing to settle the account for.

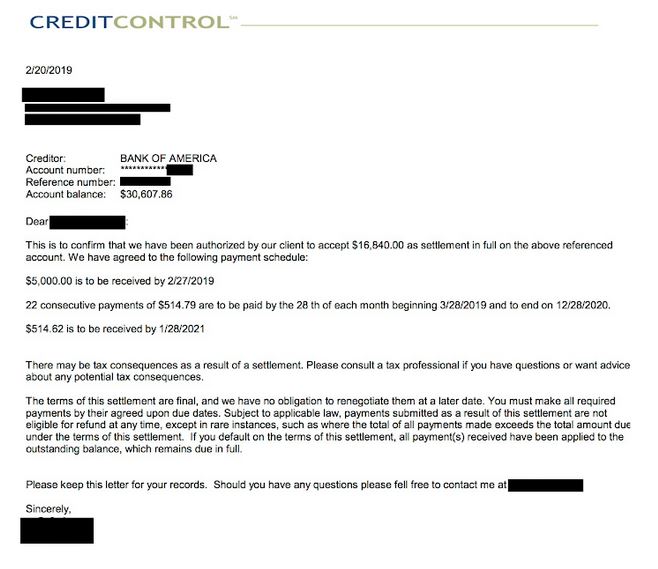

Sample letter #2

The next example we have is a settlement with Bank of America. We specifically chose to post this letter because of the very high balance that was owed. This settlement was for 55% of the total owed on the debt. This resulted in a savings of almost $14,000. That is very good. More than likely, the remaining balance was paid over a period of time rather than a big lump sum. Here is the proof…

Curadebt has many more examples of debt settlement letters posted on their website. We recommend seeing them for yourself. Let them help you take the stress out of your financial situation, contact Curadebt today.

Debt Settlement Letter Template

Not ready for a debt settlement company to do the work for you? No worries, we have you covered. If you are going to do this on your own the first thing you will want to do is to get all of your debts verified. If you are behind on your bills you may have to work through a collection agency that was hired by the credit card company. Ask them to send you a validation letter proving the debt is yours.

The collection agency has 5 days to get the letter in the mail. Once you receive the letter you will have 30 days to dispute that you owe the debt. The reason we are doing this is to make sure the company follows all the laws and rules that are set in place with collecting a debt. If the company does not do so, you have a legal right to fight them and get the debt dismissed.

If you are going to do this on your own we suggest brushing up on all of the laws and regulations of the Fair Debt and Collection Practices Act (FDCPA). Debt.com has a lot of very valuable information on their website on how to handle credit card and collection agencies. They have templates of offer letters for credit card companies, collection agencies and even counteroffer templates.

Check out their Debt Settlement Letter Templates